Comparing CFD Brokers: Key Features and Benefits to Look for

Contract for difference (CFD) trading is a type of financial derivative that allows traders to speculate on the price movements of an underlying asset without actually owning the asset. CFDs are a popular trading instrument in the stock market, providing traders with a flexible and cost-effective way to access a variety of financial markets, including equities, indices, commodities, and currencies.

To start trading CFDs, traders are required to open an account with a CFD broker. The broker acts as an intermediary between the trader and the market, providing access to trading platforms, market news, analysis, and other tools necessary for successful trading.

When choosing a CFD broker, it is important to consider factors such as trading costs, trading platforms, customer support, educational resources, and regulation. By taking the time to choose the right broker, traders can increase their chances of success in the CFD market.

Regulation and Safety of CFD Brokers

In the world of online trading, safety and security are of utmost importance. Traders want to know that their funds are safe and that the broker they are dealing with is reputable and trustworthy. This is why it is important to choose a CFD broker that is regulated by a reputable financial authority.

Regulation ensures that CFD brokers adhere to strict financial and ethical standards, providing a level of protection for traders. Regulated brokers are required to segregate client funds, maintain adequate capital reserves, and follow strict anti-money laundering (AML) and know your customer (KYC) policies.

In addition to regulatory compliance, traders should also look for CFD brokers with a strong reputation and track record in the industry. Choosing a broker with a long history of successful operations and satisfied customers can help ensure that traders receive quality service and support.

Trading Platforms and Tools for CFDs

Trading platforms are an essential part of CFD trading, as this is where traders place their orders and monitor their positions. CFD brokers offer various trading platforms, including desktop, web-based, and mobile platforms, each with its own set of features and capabilities.

Desktop platforms are typically more robust, offering advanced charting and analysis tools, customizable layouts, and a range of order types. Web-based platforms, on the other hand, are lighter and more accessible, requiring only a web browser to access and trade. Mobile platforms allow traders to trade on the go and receive real-time market updates and alerts.

In addition to trading platforms, CFD brokers also offer a range of tools and resources to help traders make informed trading decisions. These may include market news, analysis, market sentiment indicators, economic calendars, and educational resources, such as webinars and tutorials.

Types of Assets Available for CFD Trading

CFD brokers offer a wide range of financial assets for traders to trade, including:

- Equities: CFDs on individual stocks, such as Apple, Amazon, and Microsoft.

- Indices: CFDs on major global indices, such as the S&P 500, NASDAQ, and FTSE 100.

- Commodities: CFDs on gold, silver, oil, and other popular commodities.

- Currencies: CFDs on major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY.

CFD trading allows traders to access a variety of markets and instruments from a single trading account, providing flexibility and diversity in their trading strategies. However, it is important to note that trading CFDs carries risks and traders should only trade what they can afford to lose. It is always recommended to conduct proper research and analysis before placing any trades.

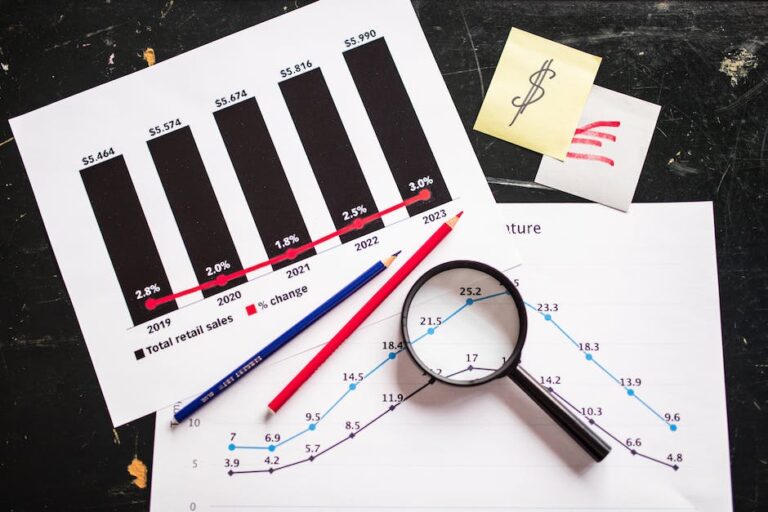

Fees and Charges of CFD Brokers

When trading CFDs, traders should be aware of the fees and charges associated with their trades. CFD brokers charge fees in various ways, including:

- Spreads: the difference between the buying and selling price of an asset.

- Commission: a fee charged per trade or per lot.

- Overnight financing: the cost of holding a position overnight.

- Inactivity fees: fees charged for inactive accounts.

- Deposit and withdrawal fees: fees charged for depositing or withdrawing funds.

It is important to understand the fee structure of a CFD broker before opening a trading account. Traders should compare the fees and charges of different brokers and choose the one that offers the most competitive rates for their trading style.

Choosing the Best CFD Broker for Your Needs

Choosing the best CFD broker for your needs can be a difficult task. With so many brokers to choose from, it is essential to consider your trading goals, style, and preferences.

When choosing a CFD broker, traders should consider the following factors:

- Regulation and safety: choose a broker that is regulated by a reputable financial authority.

- Trading platforms and tools: choose a broker that offers a trading platform and tools that suit your style and preferences.

- Assets available: choose a broker that offers a variety of assets that you want to trade.

- Fees and charges: choose a broker that offers competitive and transparent fees.

- Customer support: choose a broker that offers reliable and responsive customer support.

By taking the time to research and compare different CFD brokers, traders can find the right broker to support their trading goals and achieve success in the CFD market.